Local business proprietors use numerous hats. From handling daily operations to intending lasting development, every choice impacts the success of the business. Among one of the most crucial selections is picking the right financial institution. While standard financial institutions might look like the default choice, lending institution supply a powerful choice that several small businesses overlook.

Unlike big banks, credit unions run with a member-first approach, which can cause decrease fees, personalized solution, and much better monetary services. Understanding just how a credit union can sustain your business can be the secret to economic security and success.

The Credit Union Advantage for Small Businesses

Local business flourish on relationships, and cooperative credit union excel at fostering personal connections with their participants. Unlike huge financial institutions, lending institution focus on their neighborhood communities, meaning business proprietors get an even more tailored approach to monetary services. This personal touch makes sure that businesses aren't simply numbers-- they're valued participants with distinct requirements and objectives.

In addition, lending institution are not-for-profit organizations, which indicates they reinvest their incomes into far better prices, reduced charges, and boosted economic services. This structure directly profits business owners that need cost-efficient monetary remedies to grow and maintain their operations.

Competitive Lending Options for Small Businesses

Access to funding is a leading priority for business owners, and credit unions supply a selection of finance choices developed to fulfill the demands of growing business. Whether you require functioning funding, funds for tools, or a development strategy, credit unions supply versatile terms and affordable rate of interest.

Unlike conventional banks that often have stiff financing plans, lending institution take the time to recognize your service. Their loaning standards typically consider your organization history, future potential, and partnership with the organization. This can be a game-changer for businesses that have a hard time to safeguard funding elsewhere. In addition, local business owner that require assistance in their individual financial resources can also check out personal loans, which may offer extra financial versatility.

Modern Banking with a Personal Touch

Running a small business needs efficient and accessible financial solutions. Lending institution have actually welcomed electronic transformation, offering practical online banking solutions that equal those of larger financial institutions. From managing accounts to refining transactions and transferring funds, entrepreneur can manage their finances flawlessly from anywhere.

Yet what collections cooperative credit union apart is their capacity to mix innovation with remarkable customer care. While huge financial institutions frequently count on automated systems and chatbots, lending institution focus on human interaction. If a problem occurs, business owners can talk straight with a genuine person who recognizes their details scenario and can give personalized solutions.

Secure Savings and Competitive Interest Rates

Conserving cash is essential for business durability, and lending institution supply numerous savings options that help companies build economic gets. A money market account is a fantastic device for businesses that want to make affordable interest while keeping access to their funds. With higher rates of interest than standard savings accounts, this alternative allows businesses to grow their cash while maintaining liquidity.

In addition, credit unions supply reduced costs on examining accounts, which means businesses can maximize their earnings without worrying about excessive charges. These little yet impactful advantages make a considerable distinction in long-lasting economic planning.

Affordable Business and Vehicle Financing

For organizations that depend on automobiles for distributions, transportation, or client brows through, having the ideal financing alternatives is essential. Cooperative credit union use competitive auto loans that can assist local business proprietors money firm lorries with reduced rates of interest and flexible settlement strategies.

Unlike typical financial institutions that might have stringent financing requirements, credit unions work with participants to locate funding options that fit their needs. Whether acquiring a solitary automobile or an entire fleet, business owners can benefit from inexpensive car loan terms that support their procedures.

A Partner for Growth and Success

Beyond financial items, cooperative credit union play an energetic function in supporting neighborhood companies through education and learning, networking opportunities, and area interaction. Many lending institution provide economic literacy programs, workshops, and individually consulting to help local business owner make notified economic decisions.

Becoming part of a cooperative credit union additionally implies becoming part of a community that truly cares about your success. This connection cultivates an environment where services can team up, acquire understandings, and utilize resources that may not be readily available through larger financial institutions.

Experience the Credit Union Difference

Picking the right financial institution is a click here vital action for small business owners. Cooperative credit union supply an one-of-a-kind combination of lower fees, customized solution, and affordable economic items that aid organizations thrive. Whether you're searching for company financing, a trustworthy money market account, or obtainable online banking, a lending institution could be the perfect economic companion for your organization.

If you're all set to discover just how a cooperative credit union can support your small company, stay tuned for even more understandings and updates. Follow our blog site for the current suggestions on company banking, economic monitoring, and growth techniques customized to local business owners like you. Your success starts with the appropriate economic foundation-- discover the lending institution benefit today!

Tony Danza Then & Now!

Tony Danza Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Karyn Parsons Then & Now!

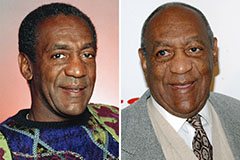

Karyn Parsons Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!